what is a fit deduction on paycheck

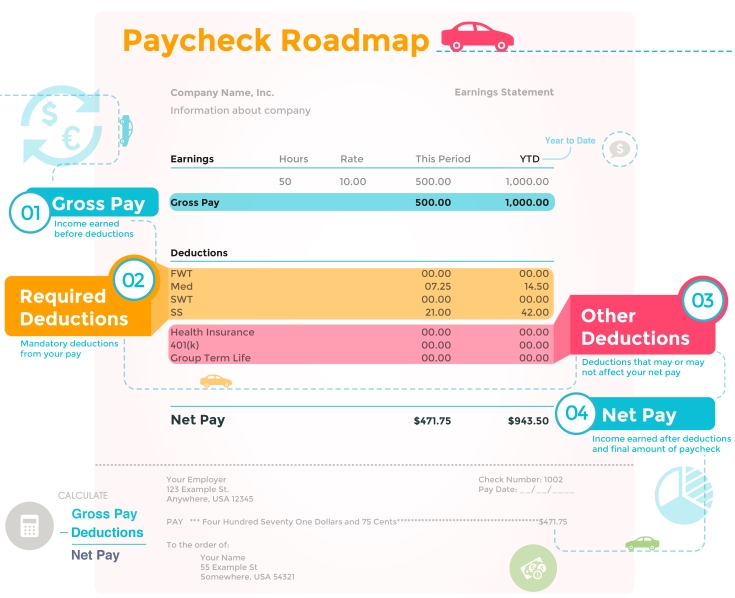

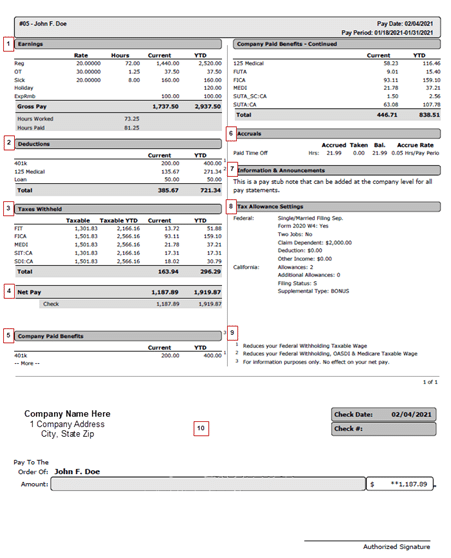

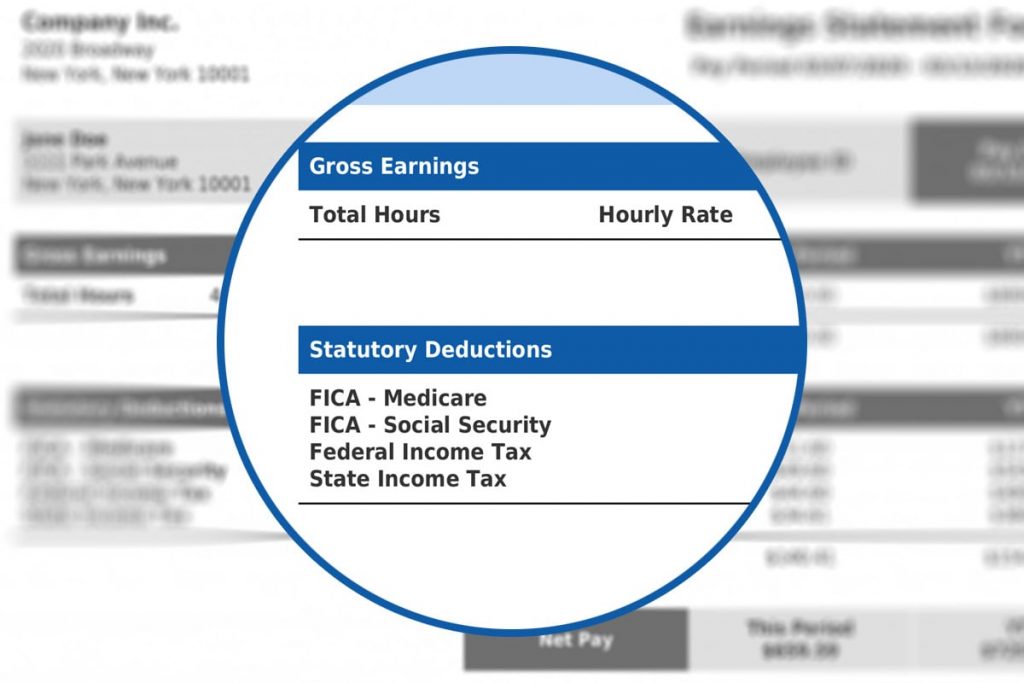

FIT deductions are typically one of the largest deductions on an earnings statement. These items go on your income tax return as payments against your income tax liability.

Understanding Your Pay Statement Innovative Business Solutions

Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits.

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

. FICA taxes are payroll taxes and they are a flat 62 social security tax and 145 medicare tax. FIT deductions are typically one of the largest deductions on an earnings statement. Ariel SkelleyBlend ImagesGetty Images.

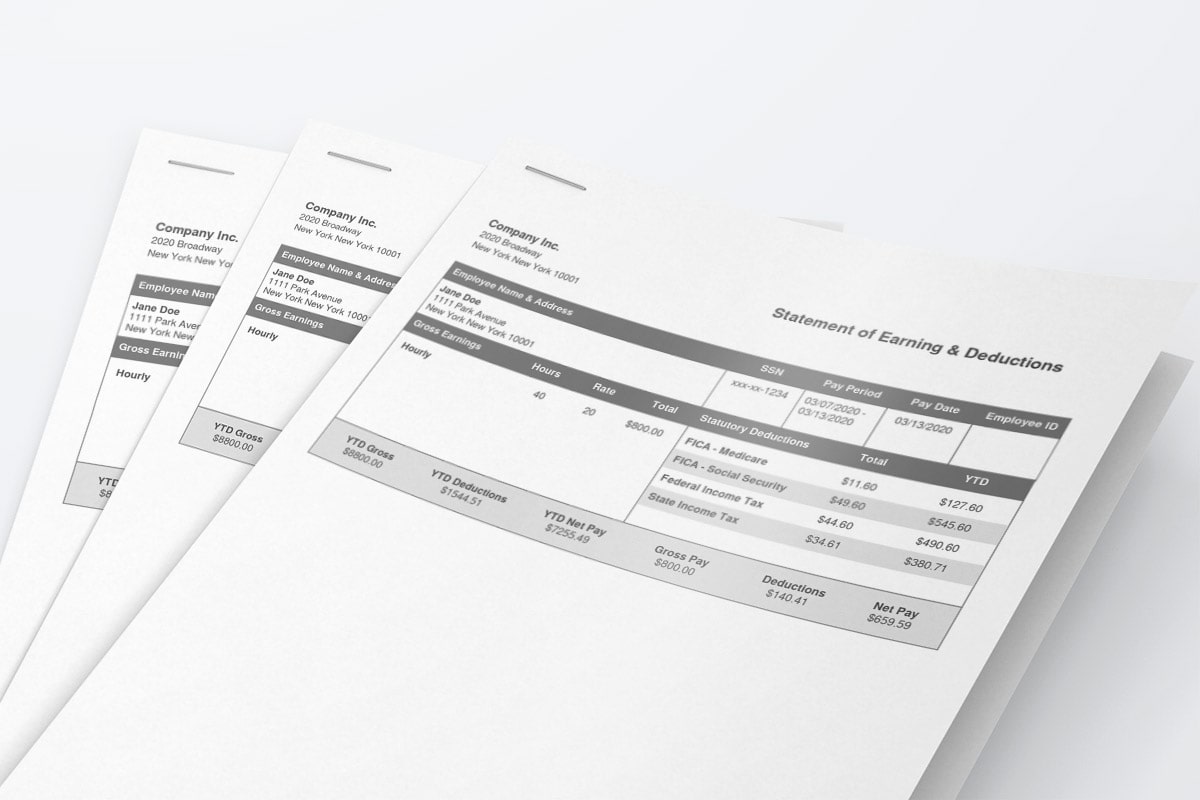

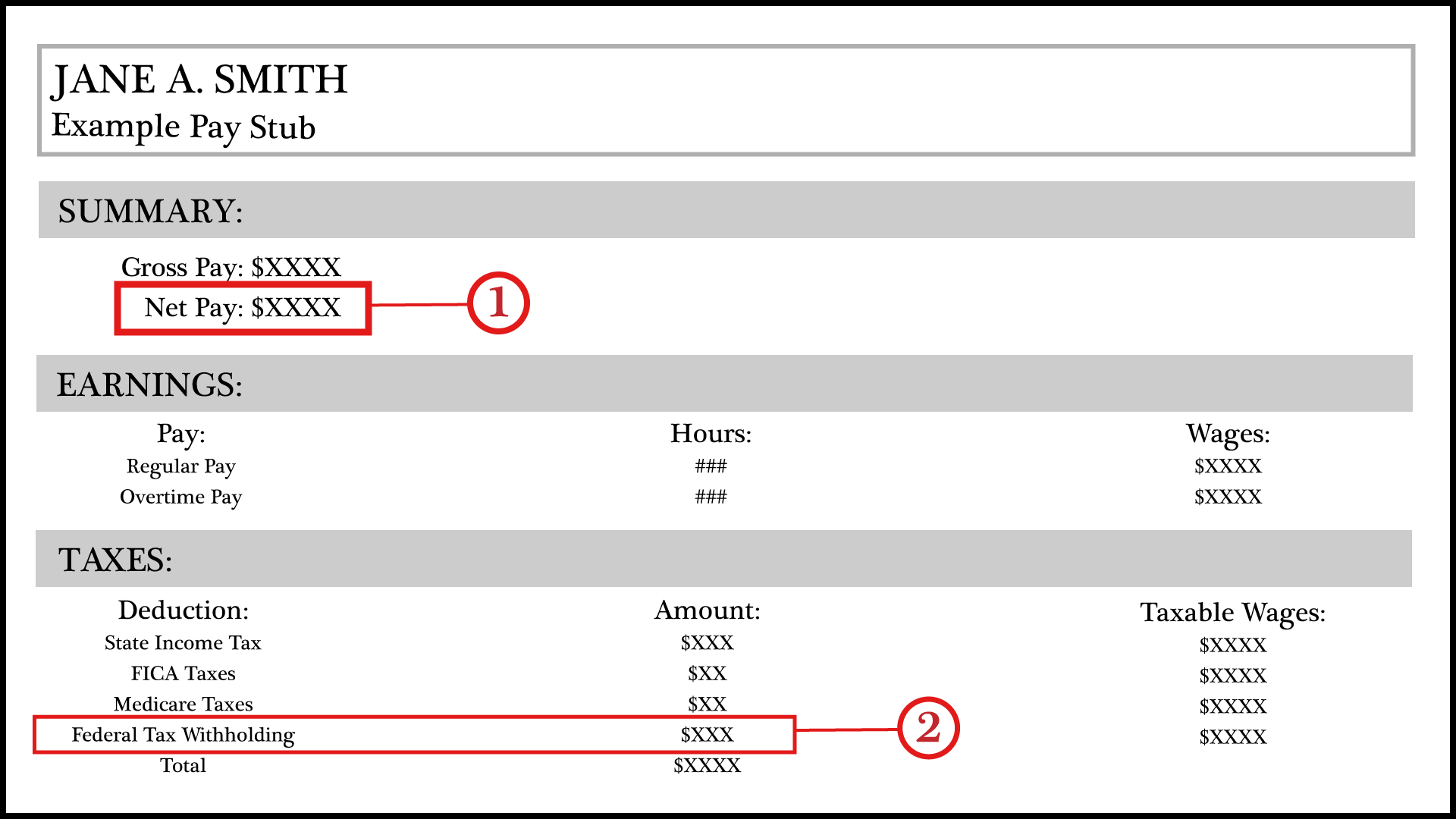

Net pay Net pay is the amount you take home after deductions are made. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. Use this calculator to help you determine the impact of changing your payroll deductions.

In the United States federal income tax is determined by the Internal Revenue Service. Federal income tax deduction refers to the amount of federal income taxes withheld from an employees paycheck each pay cycle. To calculate your tax bill youll pay 10 on.

FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. Employers withhold or deduct some of their employees pay in order to cover. The amount of money you.

These withholdings constitute the difference between gross pay and net pay and may include. Federal income tax FIT withholding FIT is the amount required by law for employers to withhold from wages to pay taxes. All but seven states AK FL NV SD TX WA and WY have state income taxes.

The Federal Income Tax is progressive so the amount will vary based on the projected annual income paid by that employer to you. TDI probably is some sort of state-level disability insurance payment eg. You can enter your current payroll information and deductions and then.

FIT is applied to taxpayers for all of their. Fit federal income tax - margnl table as requested na every fitad federal income tax - added amount as requested na every fsaf flexible spending account fee 325 post tax 2 nd garn garnishment as required post tax every garnf garnishment fee 300 post tax every gncu greater nv credit union as requested post tax every. Fit deductions are typically one of the largest deductions on an earnings statement.

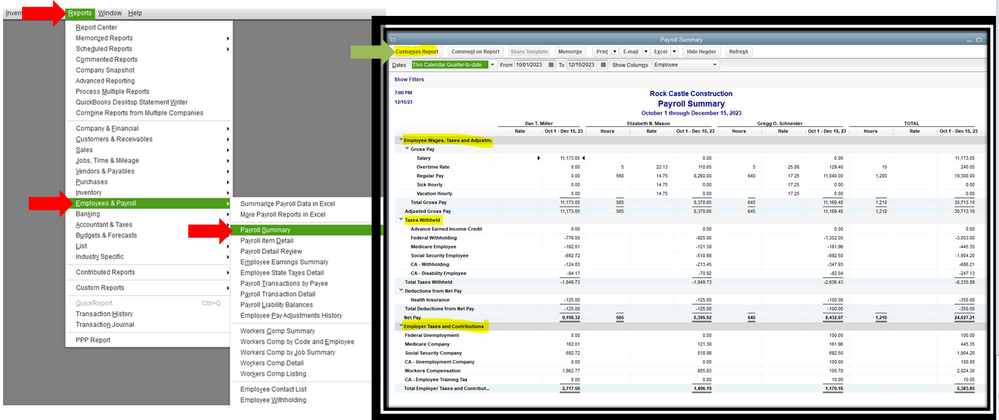

While the task of figuring out FIT withholdings for your employees may seem tricky with the help of Block Advisors payroll service or payroll software like Wave your payroll to-dos just got easier. FIT is withheld from an employees paycheck based on the amount of their federal taxable wages. In California the State Disability Insurance SDI could be used as a Schedule A.

FIT on a pay stub stands for federal income tax. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income.

Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. An individuals paycheck for state income taxes. That puts you in the 12 tax bracket.

This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Payroll taxes and income tax.

Find the section of the stub thats labeled gross pay salary or something similar. After subtracting the standard deduction of 25100 your taxable income for 2021 is 64900.

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

Solved Federal Taxes Not Deducted Correctly

Understanding Your Paycheck Credit Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

A Guide On How To Read Your Pay Stub Accupay Systems

Pre Tax Vs Post Tax Deductions What Employers Should Know

Payroll Checkup Workers Should Double Check Tax Withholding Cpa Practice Advisor

Breaking Down Paystub Deduction Codes Paystubcreator

What Everything On Your Pay Stub Means Money

What Are Pay Stub Deduction Codes Form Pros

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Hrpaych Yeartodate Payroll Services Washington State University

Different Types Of Payroll Deductions Gusto

6 Common Types Of Payroll Withholdings And Deductions Employers Resource